The 6-Second Trick For "Wire Transfers: The Ultimate Solution for International Money Movement"

How to Decide on Between ACH and Wire Transfer for Your Financial Necessities

In today's fast-paced world, the need for quick and dependable monetary purchases is a lot more important than ever. Whether you are a service manager or an individual, the choice between ACH (Automated Clearing House) and cable transmission can easily significantly affect your monetary operations. Both ACH and cable transfer promotion perks and drawbacks, so it is vital to comprehend their variations just before making a decision. In ACH or Wire Transfer write-up, we will certainly check out how to choose between ACH and wire transfer for your economic requirements.

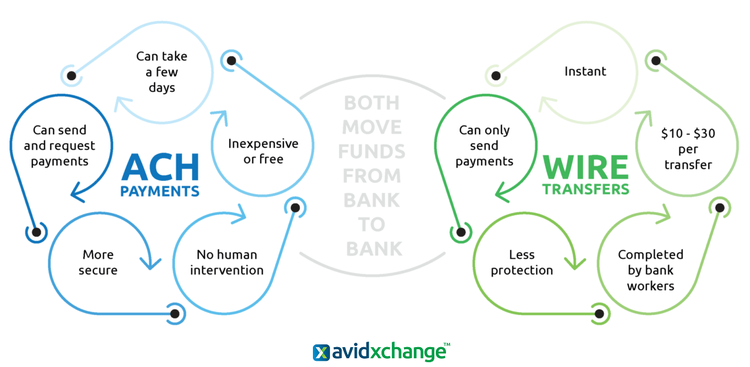

ACH is a body that permits digital funds transmissions between banking companies within the United States. It enables companies and people to deliver funds coming from one financial institution account to another without the requirement for newspaper examinations or physical cash. One of the main perks of making use of ACH is its cost-effectiveness. Reviewed to cable transfers, which usually happen along with higher fees, ACH purchases are substantially less costly, helping make them an desirable alternative for businesses that need to process several settlements routinely.

Another advantage of making use of ACH is its benefit. Along with ACH, you may book reoccuring settlements in innovation, enabling you to automate frequent deals such as pay-roll or regular monthly bill repayments. This conserves time and initiative since you don't have to launch each purchase by hand. Also, ACH transmissions commonly take one to three business days to finish, thus they are appropriate for non-urgent transactions.

On the various other palm, wire moves supply instant funds availability but happen at a much higher price matched up to ACH deals. Wire transactions are optimal when opportunity is of the importance or when large amounts of money need to have to be transmitted rapidly. Unlike ACH transactions that count on batch processing at certain periods throughout the day, wire transfers may be initiated at any kind of time as long as each banking companies involved in the purchase are available.

Cord transactions additionally deliver enriched security compared to ACH purchases since they require added authentication solution such as providing a secret code or security password. This produces cable moves a preferred strategy for high-value deals or scenarios where a greater degree of safety is necessary.

When making a decision between ACH and cord transfer, it is vital to consider the seriousness and quantity of the transaction. If time is not a essential element, and you are appearing for a cost-effective solution, ACH is the means to go. Nevertheless, if you need to have to transfer funds quickly or possess high-security demands, cable transmission may be the better option.

It's additionally crucial to keep in mind that some economic institutions possess day-to-day restrictions on ACH transactions. If you regularly need to have to move larger sums of funds, you need to ensure that your banking company permits for greater purchase limitations.

Also, global moves typically maynot be refined through ACH due to its constraint within the United States. In these cases, wire transmissions are usually the only realistic option.

In conclusion, picking between ACH and cable transmission relies on various elements such as cost-effectiveness, comfort, rate, safety requirements, and transaction limitations. While ACH delivers reduced price and advantage for non-urgent transactions along with routine intervals, cable transactions give instant availability and enhanced security component at a greater price. Through assessing your particular financial needs and looking at these elements meticulously, you may make an informed decision on whether to use ACH or wire transfer for your monetary deals.